Introduction

Is the fear of financial tracking and recordkeeping holding you back from starting your side hustle? Or maybe you’ve been in operation for a few years but you’re struggling to understand how to organize your books and records. In years past our only option was paper and pen, but as technology has evolved, we’re open to more possibilities, the most common of which we’ve summarized below.

Methods of Compiling Profit and Loss

Three common ways to assemble your financials are by using software, with an electronic spreadsheet, and on paper.

Using Software (QuickBooks, Xero etc.)

Perhaps the most productive and convenient way to compile your financials is through the use of an accounting software. QuickBooks, Xero and other similar companies offer online and/or desktop versions of their programs to users with a variety of features, often dependent on the “level” of membership they subscribe to. For instance, QuickBooks Self-Employed is for Schedule C filers and is the base level of membership. It allows users to automatically import their transactions from their bank accounts and credit cards for categorization, includes basic reports, invoicing, payments, and receipt upload, and allows for 1099 preparation for Contractors. In addition to these capabilities, the Plus plan offers comprehensive reports, additional users, and time and inventory tracking.

The main benefit to using an accounting software to track income and expenses is that it saves time. By setting up transactions for automatic import from one’s bank account or credit card, you eliminate the need to manually download a spreadsheet from your account or summarize by hand. Additionally, these tools will often allow you to create “Rules” to automatically categorize certain items whenever they are incurred – for instance, all Home Depot expenses as Repairs, or all Verizon Expenses as Telephone. However, most (but not all) programs do come with a subscription fee, and if you cancel your subscription, you will likely lose access to the data you’ve worked hard to organize. This method is best for profitable companies outgrowing their current methods, companies with a larger number of transactions, and owners who need to free up more time to spend in their business. Additionally, if you plan to work with a CPA firm for your recordkeeping it is likely they will want to go this route.

With an Electronic Spreadsheet (Excel, Google Sheets, Numbers etc.)

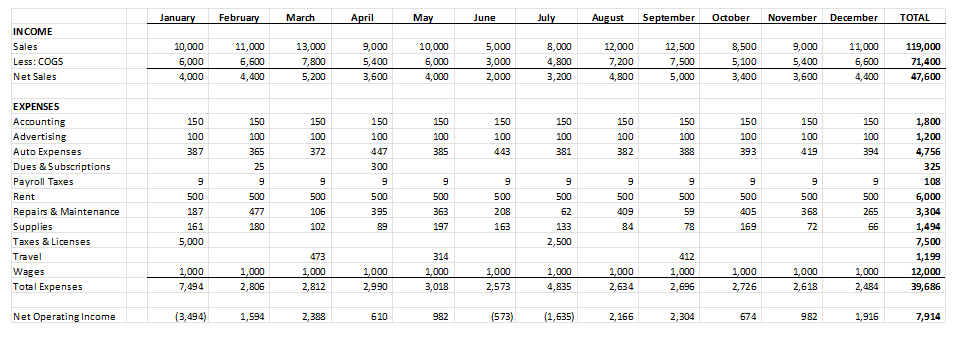

Electronic spreadsheets are powerful tools with potential far past what most of us comprehend. At their most basic level, they allow us to do what we would with a paper spreadsheet, but with some time-saving automation. To use an electronic spreadsheet to track income and expenses, you would set up your page something like this:

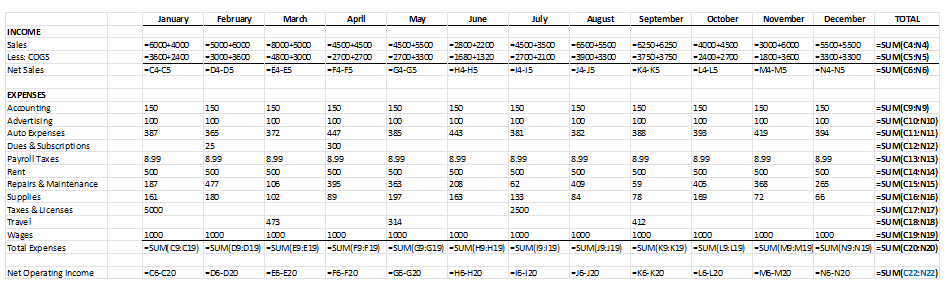

This is a Profit and Loss report manually created in Excel, similar to a simplified version that accounting software would generate automatically. Income and expense amounts may be entered into cells as they’re incurred. While the above may not look any more impressive than a paper spreadsheet, look at the same page from the formula view:

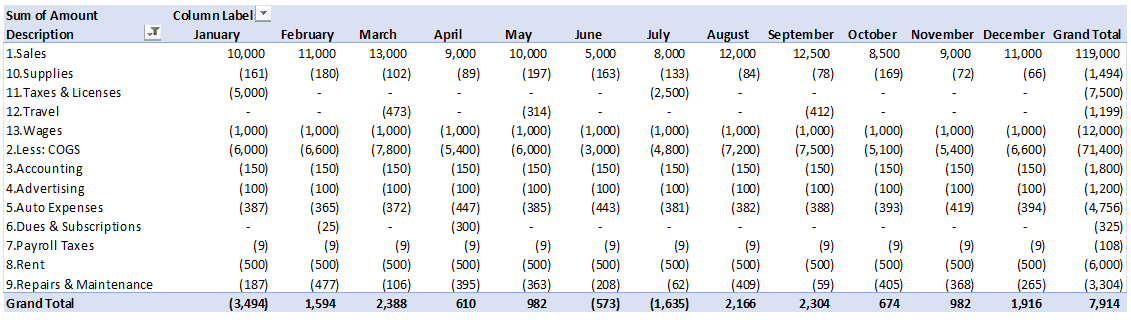

Using formulas, you’re given the ability to add individual items within a cell automatically, or total a row or column, thereby eliminating the need for manual calculations, not only saving time but reducing the likelihood of errors. If you’re looking for an even quicker, more advanced route, you could take it a step further and export an entire year’s worth of transactions from your bank, add a Category column and create a pivot table that provides a layout substantially similar to the above:

As with utilizing accounting software, electronic spreadsheets are a productive way to track income and expenses and allow for easy updates. As an added benefit, you can save your files directly on your hard drive, or in cloud storage, so you don’t have to worry about losing access to them. This method is also free. However, accounting programs offer many additional features that you may need regardless, such as payroll processing. It also offers enhanced reports at the click of a button, while you’d be facing a potentially large learning curve and an additional time investment if attempting to put together the same yourself. We recommend the use of electronic spreadsheets to newer, smaller, or less profitable companies with a tech-savvy owner or employee.

On Paper

While we would not recommend going this route to organize your financial information, it is possible. Using a paper spreadsheet, you can keep track of your financials in a fashion similar to the above, likely using one page per month and listing new transactions as they are incurred, then summarizing columns/rows at the end of a page and adding monthly totals at the end of the year. This method is cumbersome for several reasons:

It’s Slow

By some estimates, typing is approximately three times faster than writing by hand. Our guess is that the automatic bank import and rule features that come with accounting software are a bit quicker as well.

You’re More Prone to Errors

With an electronic spreadsheet you’re able to copy and paste numbers into your page and create formulas to total columns and rows. By handwriting and manually calculating, you’re more likely to fat finger or miswrite an item.

You Can’t Save a Backup

Consider the importance of the data you’re compiling. If you were to lose your notebook or there was a fire at the place you housed your records, you would be in big trouble.

You Can’t Manipulate Your Data

One of the biggest benefits to electronic spreadsheets is the ability to manipulate data. In a matter of seconds to minutes you’re able to sort, filter or create tables or charts from your information.

Methods of Retaining Documentation

When considering document retention methods, there are three common approaches that compliment those described above: importing files into software, file scan, and paper retention.

Importing Into Software

As mentioned previously, Quick books, and likely other accounting programs, allow(s) for receipt upload. You’re able to take a photo of your receipt, check stub, deposit slip etc. from your phone and attach it to a transaction via the online application or attach a file in the browser and desktop versions. While this is a very organized way to store your records, you may lose access to your support if you cancel your subscription.

Scanning Files

Another quick, easy, and protected way to store your income and expense support is by scanning the files. There are multiple options for how and where you scan and store your files. While the obvious is using a traditional scanner and saving to your hard drive or an external drive, your smartphone may have a built-in document scan function that takes clear photos of documents and cuts out the background, which you can then save on a folder on your phone, in cloud storage, or a combination of the two. Depending on your settings, you may even be able to sync your files between your computer, phone, and cloud drive so you can store and access the file in the same place on all three. This is a very convenient option for a busy business owner or landlord.

Retaining Paper Documents

Finally, an option is always to save your documents the traditional way and store your paper files. If going this route, we recommend avoiding the “shoebox of receipts” and suggest a clear organizational method, such as creating separate folders for each company or location and each tax year; if you have a lot of transactions, it may be best to clip together documents by category as well (sales receipts/invoices, repairs receipts etc.). As with compiling financials on paper, we do not recommend retaining documentation in this manner. You are much more likely to misplace or otherwise lose access to support that you may need down the line.

Conclusion

If you’re ready to improve (or begin) your financial organization methods, Gulla CPA is available to help. We offer in-house bookkeeping with QuickBooks software as well as hourly consultation on any of the methods above. Give us a call or fill out an inquiry to schedule an appointment.